The smart Trick of Redbud Advisors, Llc That Nobody is Discussing

Bookkeeping and accounting services (along with other solution lines, such as easy tax obligation preparations) are almost universally billed as a dealt with cost, and there is a market expectation for that rates framework. When identifying a cost structure, lots of accountants call other companies and ask for quotes. They use the standard of those quotes to figure out a reasonable and competitive rate for their services.

The Ultimate Guide To Redbud Advisors, Llc

A lot of the bigger ones (such as the National Organization of Tax Preparers) will certainly disperse suggested rate frameworks and various other valuable details - Dispensary Regulations OKC. While you do not have to be a CPA to prepare or file taxes, the training and proficiency it requires to gain that credential matters. Merely placed, you're a CERTIFIED PUBLIC ACCOUNTANT, and you are entitled to a costs for your solutions

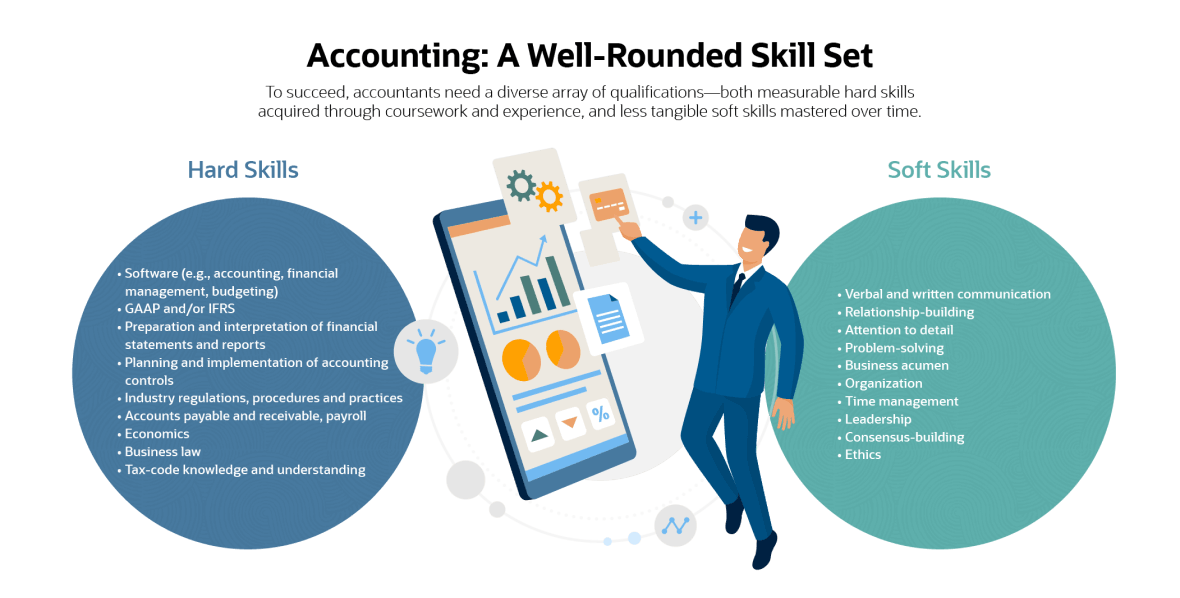

When employing, accountancy firms are like many companies and are looking for a combination of credentials, experience, and the capacity to do the essential jobs. However, in an increasingly competitive working with market, numerous firms are starting to check out soft skills as valuable for new hires. For decades, accountancy companies have actually focused mainly on credentials.

The Greatest Guide To Redbud Advisors, Llc

Whichever framework you choose at the start, recognize that it will likely evolve throughout the maturity of your company. A company might accept the danger and start as unincorporated to prevent the incorporation fees.

Lots of people will not simply call a number without the opportunity to do some standard on-line study. However, there is a difference in between an internet site visibility and social networks. In many cases, a web site is fixed and enables organizations to transmit standard, evergreen details such as contact number, solutions provided, and qualifications.

Redbud Advisors, Llc for Beginners

It's not as a lot an inquiry of "needs to you" however "can you." Lots of if not most firms will begin as generalists and after that gradually make their way a much more particular niche method. Sometimes a firm will deliberately develop customers in one location. Others understand they have, say, many construction customers and after that relocate to the certain specific niche.

Redbud Advisors, Llc for Dummies

Acquiring expert associations is necessary. They can aid distinguish you in an open market and more signal your specific niche work. Particular niches, like numerous points, are usually depending on area, rate of interest, and understanding where there is a requirement throughout various businesses. Nevertheless, a few of one of the most successful specific niches are the ones offering fellow professionals such as medical professionals, dental practitioners, attorneys.

Whether you run a brick-and-mortar organization or a digital one, having an expert location to meet navigate to these guys clients is crucial. Clients want comfort and assurance. Clients desire the guarantee that, if the IRS or an additional governing authority follows them, that you be my defender and stand between them and the organization? Extending that sense of comfort is going to assist influence them - https://www.anyflip.com/homepage/eiaww#About.

Indicators on Redbud Advisors, Llc You Should Know

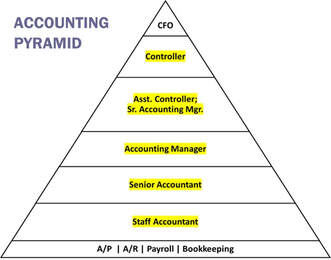

Advisory services branch even more into: M&An advisory Restructuring Due diligence Consulting Assessment is the technique of identifying truth well worth of a firm or asset. Oklahoma Cannabis Laws. Solid logical expertises, a capacity to interpret financial statements, and experience in economic markets are critical for those to prosper at a profession in assessment

What Does Redbud Advisors, Llc Do?

Frequently, employees will invest a couple of years within expert solutions companies and delegate go after profession chances on the buy side or at huge companies. Expert solutions firms tend to supply less compensation than other areas of finance, such as the buy side and market side. Nonetheless, administration consulting functions at prestigious firms are connected with better pay and incentive possibilities.

Some members of the accounting occupation might stand up to these adjustments, stated Bill Reeb, CPA/CITP, CGMA, a professional that is chief executive officer of the Succession Institute and vice chair of the AICPA. "Once our professionals move right into spending more time in this higher-valued advisory room, we're mosting likely to go kicking and screaming to a location we will certainly enjoy to be," he claimed.

Redbud Advisors, Llc for Dummies

The accessibility to full data sets will certainly turn the auditing process upside down. Rather of starting with aggregated data such as the test balance or accounts receivable and afterwards testing samples of transactions to develop an opinion on the credibility of the whole information set, bookkeeping in the future will certainly consist of constant tracking of transactional information.

Auditors will certainly then investigate those alerts (https://qualtricsxm6pqtn456s.qualtrics.com/jfe/form/SV_cDca3BCsh7xNDEy). "Auditing is transferring to systems, process, and individuals, as opposed to a special emphasis on the numbers," stated Anderson, that serves as an advisor to the AICPA's audit of the future campaigns and additionally leads the AICPA/Rutgers Information Analytics Initiative, which is conducting research study to figure out the very best means to promote the combination of data analytics in the audit process